HRB is a community land trust (CLT). CLTs are nonprofit organizations that conserve land for affordable housing, removing it from the profit-driven real estate market and using it for the long-term benefit of the community. They build or acquire homes and sell them to income-eligible households. But they never give up ownership of the land. Instead, they lease it to the homeowner for a 99-year term with the option to renew. Regulations in the ground lease—not market forces—dictate the sale price, ensuring that these homes remain affordable to future buyers while still allowing the seller to build equity. CLTs can also include rental homes, farmland, and business and community spaces. HRB has 90 rental homes and 44 homes for ownership, with many more in the pipeline.

Stewardship is a key component of the community land trust model and shows itself in the long-term, supportive relationships we form with our tenants and homeowners. We offer rental assistance to income-qualified households, and we operate a homeownership program, which shepherds prospective homeowners through the homebuying process and supports current owners in maintaining the physical health of their homes and accessing appropriate financial resources. When the time comes to sell, we find a buyer who meets our income qualifications and facilitate the sale without charging a commission.

Community land trust homes make maximum use of land and funding, and they align housing prices with wages.

Here’s what happens when there are no resale restrictions:

- The individual homeowner sells at market rate, which on Bainbridge might mean considerable profit, maybe even enough to buy a home on the open market. Only one household benefits from the initial public and private subsidy that went into creating an affordable home.

- The community loses an affordable home. If it is to continue to create a place for people whose work and life circumstances make buying a market-rate home impossible, more land and funding must be found to build a replacement. Given the rising cost of construction, the new home will be more expensive to build than the original. And land will likely be harder to come by. We are seeing other affordable housing nonprofits, without resale restrictions, run out of available land on which to build.

With their resale restrictions, community land trust homes continue to give back to the community, serving generations of low-income families to come.

While it is true that community land trust homeowners cannot sell at market rate and therefore won’t make the outsize profit so many associate with real estate, they earn equity by paying down the mortgage principal and ultimately, by selling at a price that reflects a small percentage of appreciation. (HRB homeowners earn a maximum 1.5% annual return.) Equally important, mortgage payments are fixed and often become increasingly manageable. Rent can only go up.

Recently, an HRB home, appraised at $604,500, sold for $185,107. The price was affordable to the buyer, and the seller earned $62,000 in equity over eight years.

CLT homes are inheritable.

Homeownership is not right for everyone at every time in life. People across the income spectrum might opt to rent because of the inability or lack of desire to maintain a property, the necessity of frequent moves, the freedom to downsize, or because they cannot afford a down payment for a desirable home.

HRB owns 42 rental units distributed across seven properties. We own a minority stake in another 48 units at Island Terrace. There are 44 homes for ownership.

Our land trust is growing. We are purchasing 13 units in the upcoming Wyatt & Madison development at the cost to build and are in the predevelopment phase of the Ericksen Community, an 18-unit rental residence on Ericksen Avenue. We are acquiring 31 townhomes in the 73-unit Wintergreen Townhomes development off High School Road, now under construction.

That depends. What is affordable to someone earning $200,000 is not the same for someone earning $30,000.

Affordability is usually assessed as a percentage of income with conventional wisdom dictating that households pay no more than 30% of gross household income on rent and utilities. Though useful as a rough guide, the 30% rule has its limitations. Paying 30% of a $200,000 salary leaves plenty to cover basic needs such as food, transportation, and healthcare. Paying 30% of a $30,000 salary, however, will likely mean a struggle to make ends meet. The situation becomes even more nuanced when other factors are introduced, such as family size. A single person earning $30,000 will fare better than a mother with two children who earns the same salary but spends more on clothing, food, and medical bills.

HRB is more flexible when determining income eligibility for rentals, placing utmost importance on being housed and providing rental assistance when necessary. For homeownership, we use 35%.

HRB mostly provides affordable housing, which means that our rents are priced below market rate. Tenants must be able to pay the rent as it is charged.

With subsidized housing, tenants pay 30% of their income in rent, and another entity, usually a government program, picks up the balance. The federal Section 8 voucher program, named for the legislation that authorized it, has two types of subsidies: project-based and tenant-based. With project-based vouchers, households in some or all the units in a building pay 30% of their income in rent. With the tenant-based version, the tenant possesses a portable housing voucher which allows them to choose a home in the private sector and pay 30% of their income in rent. The remaining rent is covered by a housing subsidy from the local public housing agency. These homes must meet the requirements of the program such as charging fair-market rent and meeting certain health and safety standards.

Both types of vouchers are issued by HUD to local public housing agencies, which then distribute them to local housing providers and home-seekers. The wait list for tenant-based Section 8 vouchers is now closed. In 2023, the Bremerton Housing Authority distributed 65 project-based vouchers in Kitsap County through a competitive process. HRB was award 14. Seven have been distributed among our current properties and seven are reserved for the Ericksen Community, now under development. The vouchers will make it possible for people with little to no income to live in these homes without receiving rental assistance from HRB.

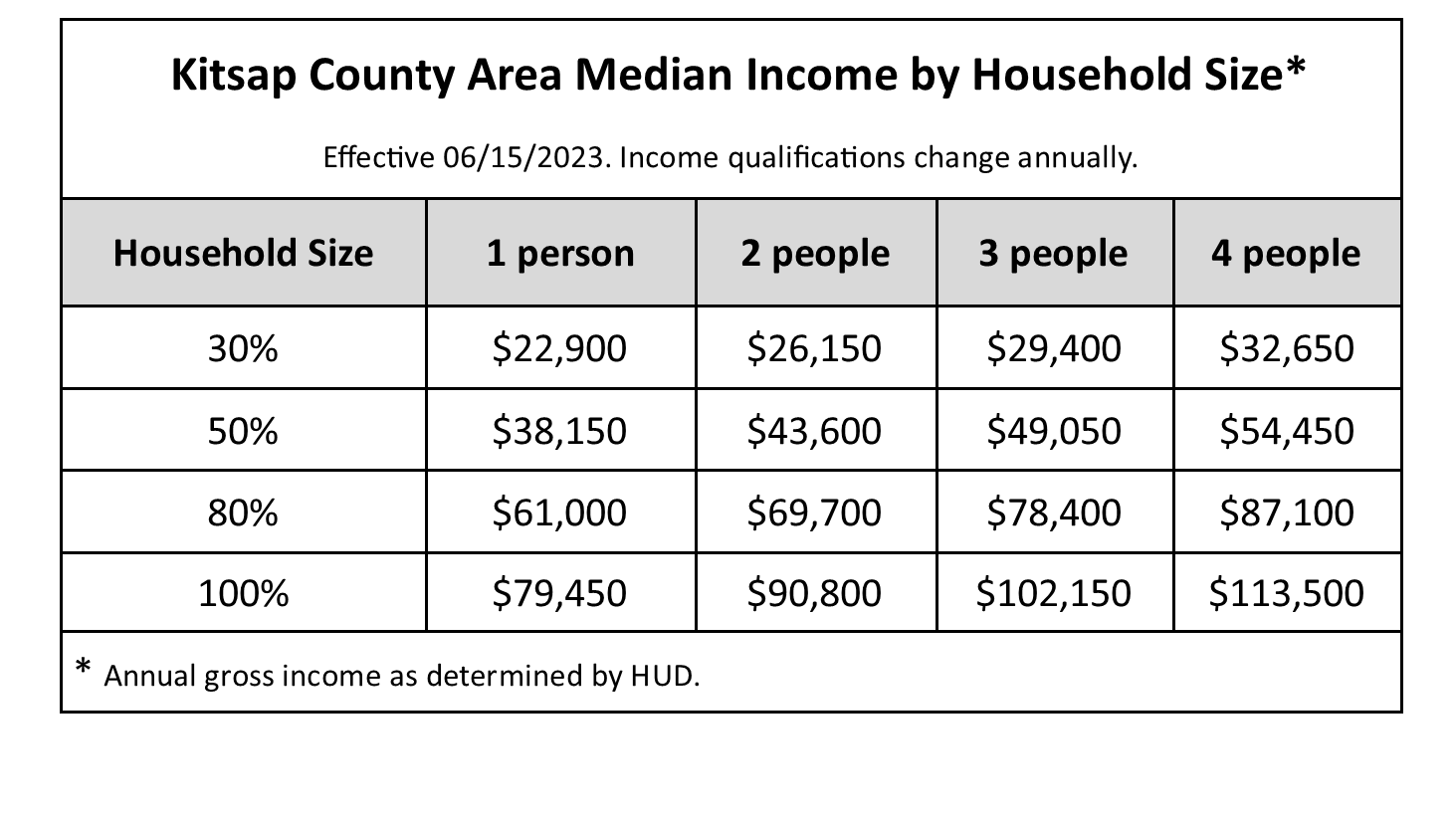

Area median income.

HRB and other affordable housing providers use the area median incomes determined by HUD. HUD begins by calculating the area median income for a family of four in a specific region (in our case, all of Kitsap County). It then adjusts this income according to family size using a special formula. These figures are used as income limits to determine eligibility for affordable housing.

If you visit the U.S. Census, you can find the median income for Bainbridge Island. This will be different than what appears here. It reflects Bainbridge Island only, does not account for family size, and uses different methodology for extracting data from the census.

HRB serves primarily low-income households. Low income is defined as at or below 80% area median income (AMI). However, we have a few homes for sale available to moderate-income households, earning as much as 120% AMI.

For reference, a store clerk earning $22/hour would fall at 64% AMI, and a receptionist earning $18/hour would fall at 52%.

Every unit has its own income qualifications depending on the requirements of the government program which funded its construction. For example, one unit might be reserved for households below 50% AMI and another, for households below 80%.

278. Ninety are owned by HRB.

HRB envisions multifamily affordable housing in areas consistent with the guiding principles of the Bainbridge Island Comprehensive Plan, specifically the Winslow Town Center, High School Road Area, and neighborhood centers.

These areas are intended to accommodate growth. HRB would like to see both exclusively affordable development and units integrated into market-rate complexes in what is called “inclusionary zoning.” We also support scattered-site affordable homeownership elsewhere on the island in manner that is consistent with zoning.

Our 100% affordable Ferncliff Village neighborhood, with 16 townhomes and 24 single-family homes, occupies a 6-acre site donated by longtime island residents, Lois and King Curtis. Should another opportunity arise, HRB has the experience and connections to build a similar community of affordable, sustainable, and quality homes.

While denser housing, both small single-family and multifamily, might look different than the ways we have built in the past, it is the most environmentally sustainable way to build moving forward. Denser housing is less land intensive and is the perfect counterpart to conservation. Denser housing reduces suburban sprawl, requiring fewer new roads and wells, and consumes less animal habitat. And denser housing, specifically multifamily housing, is more energy efficient in heating and cooling. The environmental benefits only accrue when this housing is located near public transformation or within walking and/or biking distance of amenities.

Denser housing is also less expensive, as the cost of land is distributed over many units. It is almost impossible to build affordably in any other way.

Yes. Former city hydrogeologist Maureen Whelan was hired to monitor groundwater in the context of population growth and climate change. “Based on my research and understanding of the island’s groundwater sources and uses,” Whelan said, “it appears that groundwater resources are currently sufficient. However, that doesn’t mean we shouldn’t be planning for careful stewardship of those resources.” (COBI Connects, Winter 2022)

HRB, too, appreciates the need to steward this precious resource. Water levels are impacted more by recharge than by pumping. Housing that occupies a small footprint, as HRB homes do, is one way to mitigate our impact on the island’s aquifers as impervious surfaces, such as roads, roofs, and driveways, prevent rainwater infiltration and natural groundwater recharge.

This question often comes up around affordable housing, specifically. However, affordable housing on Bainbridge developed by HRB and other entities accounts for a tiny percentage of land coverage.

The city is developing a groundwater management plan due this fall. You can read the city’s groundwater fact sheet here.

The median sale price on Bainbridge is about $1.3 million, which requires an annual income of close to $300,000 and a down payment of $260,000. The median rent for a two-bedroom apartment is $2,605, which requires an income of $104,200.

HRB is concerned about demographic changes that undermine the health of our community and can be attributed in part to the island’s high-priced real estate.

- Two-thirds of the people who work on Bainbridge commute from off-island. Not only do these workers face an unsustainable commute, services on Bainbridge, be they elder care or grocery stores, are vulnerable in the event of bad weather or emergency.

Click to enlarge

https://onthemap.ces.census.gov

- The average age on Bainbridge is 50. It’s 39 in all of Kitsap County and 38 in Bellevue.

- School enrollment is dropping.

Click to enlarge

HRB works to prevent homelessness by providing below market-rate, long-term homes to low-income households. We do not provide transitional housing, nor do we provide social services to unhoused individuals.

We’ve got answers

(16 of them, in fact)

If you’ve got a question that you don’t see here, please reach out to HRB at info@housingresourcesbi.org.